Download the latest CBSE Class 12 Economics Government Budget And The Economy Notes Set B in PDF format. These Class 12 Economics revision notes are carefully designed by expert teachers to align with the 2025-26 syllabus. These notes are great daily learning and last minute exam preparation and they simplify complex topics and highlight important definitions for Class 12 students.

Chapter-wise Revision Notes for Class 12 Economics Part B Macroeconomics Chapter 5 Government Budget and The Economy

To secure a higher rank, students should use these Class 12 Economics Part B Macroeconomics Chapter 5 Government Budget and The Economy notes for quick learning of important concepts. These exam-oriented summaries focus on difficult topics and high-weightage sections helpful in school tests and final examinations.

Part B Macroeconomics Chapter 5 Government Budget and The Economy Revision Notes for Class 12 Economics

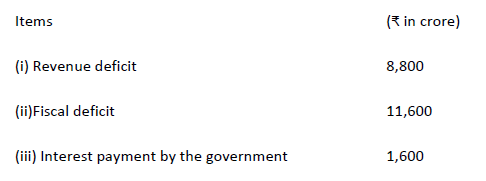

Question: Find primary deficit from the following data:

Answer: Primary Deficit= Fiscal deficit – Interest payment by the government

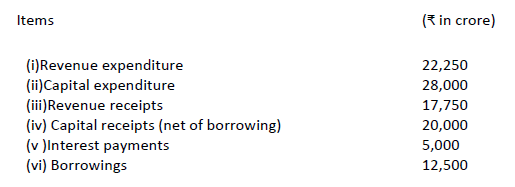

Question: Calculate Revenue Deficit. Fiscal Deficit and Primary Deficit from the following data

Answer: Revenue Deficit = Revenue expenditure – Revenue receipts

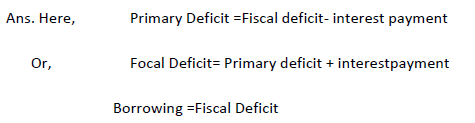

Question: Find borrowing by the government of payment of interest is estimated to be of ₹15,000 crore which is 25 % of primary deficit.

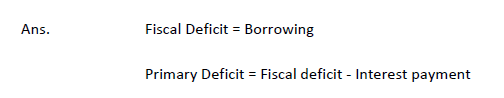

Question: Revenue deficit is estimated to be ₹ 20,000 crore, and borrowing is estimated to be 15,000 crore. expenditure on interest payment is estimated to be 50% of the revenue deficit, find fiscal deficit and primary deficit.

Answer:

Question: Comment on the following statements as true or false, with a reason.

(i) Construction of school-building is a revenue expenditure of the government.

(ii) Gift tax is a capital receipt.

(iii) Dividends on investment made by government is a revenue receipt

Answer: (i) capital expenditure

(ii) revenue receipt.

(iii) revenue receipt

Question: Categories the following government receipts into revenue and capital receipts. Give reasons for your answer.

Answer:

(i) capital receipt

(ii) capital receipt

(iii) revenue receipt.

(iv) revenue receipt

Question: Why should revenue deficit be curbed?

Answer: Revenue deficit often occurs when unproductive expenditure of the government is in excess of the tax and non-tat revenue receipts.

Question: Finance Minister has announced that steps would be taken to rationalize dominate the economy of the nation. What is the economic value of this statement?

Answer: Expenditure on subsidies is mostly unproductive

Question: How the decline in the price of crude oil in the international market helped the government to reduce fiscal deficit?

Answer: It has raised tax revenue of the government. Accordingly, fiscal deficit has reduced.

EVALUATION (VALUE-BASED QUESTIONS)

Question: How can the government impact allocation of resources through its budgetary policy?

Answer: Following observations highlight how the government can impact allocation of resources though its policy:

(a) The government can offer subsidies on such goods like coarse cloth the production of which is essential for poorer sections of the society. So that, the resources are shifted from the production of ‘goods for the rich to the production of goods for the poor’.

(b) The government can grant tax holiday

(c) The government can impact allocation of resources by shifting its own investments from inefficient to efficient units of production.

(d) High taxation can be imposed on such goods ,the production of which is harmful to the society.

(e) The government can make larger budgetary allocations for its ‘Support Price Policy’ in favors of food crops .

Question: Do you approve of disinvestment as a prudent means of financing budgetary deficit?

Answer: Disinvestment occurs when the government chooses to sell its stake in public sector or joint enterprises .To remember-

(i) it should unload shares of only inefficient enterprises.

(ii) Money received through disinvestment should be for productive investment.

Question: How would you distinguish between development and non-development expenditure?

Answer: Development expenditure is related to investment expenditure or productive expenditure.

Non-development expenditure is related to consumption expenditure by the government.

| CBSE Class 12 Economics Introduction |

| CBSE Class 12 Economics Consumer Behaviour And Demand Notes |

| CBSE Class 12 Microeconomics Production Possibilities Curve Notes |

| CBSE Class 12 Microeconomics Features Of Perfect Competition Notes |

| CBSE Class 12 Microeconomics The Theory of the Firm under Perfect Competition Notes |

| CBSE Class 12 Economics Consumer Equilibrium And Demand Notes |

| CBSE Class 12 Microeconomics Consumers Equilibrium Notes |

| CBSE Class 12 Economics Forms Of Market And Price Determination Notes |

| CBSE Class 12 Economics Introduction and Structure of MacroEconomics Notes |

| CBSE Class 12 Economics Market And Price Determination Notes |

| CBSE Class 12 Economics National Income Accounting Notes Set A |

| CBSE Class 12 Macroeconomics National Income And Related Aggregates Notes |

| CBSE Class 12 Economics Money And Banking Notes |

| CBSE Class 12 Economics Determination Of Income And Employment Notes |

| CBSE Class 12 Economics Government Budget And The Economy Notes Set A |

| CBSE Class 12 Economics Government Budget And The Economy Notes Set B |

| CBSE Class 12 Economics Bop And Foreign Exchange Rate Notes |

Important Practice Resources for Free Printable Worksheets PDF

CBSE Class 12 Economics Part B Macroeconomics Chapter 5 Government Budget and The Economy Notes

Students can use these Revision Notes for Part B Macroeconomics Chapter 5 Government Budget and The Economy to quickly understand all the main concepts. This study material has been prepared as per the latest CBSE syllabus for Class 12. Our teachers always suggest that Class 12 students read these notes regularly as they are focused on the most important topics that usually appear in school tests and final exams.

NCERT Based Part B Macroeconomics Chapter 5 Government Budget and The Economy Summary

Our expert team has used the official NCERT book for Class 12 Economics to design these notes. These are the notes that definitely you for your current academic year. After reading the chapter summary, you should also refer to our NCERT solutions for Class 12. Always compare your understanding with our teacher prepared answers as they will help you build a very strong base in Economics.

Part B Macroeconomics Chapter 5 Government Budget and The Economy Complete Revision and Practice

To prepare very well for y our exams, students should also solve the MCQ questions and practice worksheets provided on this page. These extra solved questions will help you to check if you have understood all the concepts of Part B Macroeconomics Chapter 5 Government Budget and The Economy. All study material on studiestoday.com is free and updated according to the latest Economics exam patterns. Using these revision notes daily will help you feel more confident and get better marks in your exams.

You can download the teacher prepared revision notes for CBSE Class 12 Economics Government Budget And The Economy Notes Set B from StudiesToday.com. These notes are designed as per 2025-26 academic session to help Class 12 students get the best study material for Economics.

Yes, our CBSE Class 12 Economics Government Budget And The Economy Notes Set B include 50% competency-based questions with focus on core logic, keyword definitions, and the practical application of Economics principles which is important for getting more marks in 2026 CBSE exams.

Yes, our CBSE Class 12 Economics Government Budget And The Economy Notes Set B provide a detailed, topic wise breakdown of the chapter. Fundamental definitions, complex numerical formulas and all topics of CBSE syllabus in Class 12 is covered.

These notes for Economics are organized into bullet points and easy-to-read charts. By using CBSE Class 12 Economics Government Budget And The Economy Notes Set B, Class 12 students fast revise formulas, key definitions before the exams.

No, all study resources on StudiesToday, including CBSE Class 12 Economics Government Budget And The Economy Notes Set B, are available for immediate free download. Class 12 Economics study material is available in PDF and can be downloaded on mobile.