Read and download the CBSE Class 11 Accountancy Accounts From Incomplete Records Worksheet Set B in PDF format. We have provided exhaustive and printable Class 11 Accountancy worksheets for Chapter 11 Accounts from Incomplete Records, designed by expert teachers. These resources align with the 2025-26 syllabus and examination patterns issued by NCERT, CBSE, and KVS, helping students master all important chapter topics.

Chapter-wise Worksheet for Class 11 Accountancy Chapter 11 Accounts from Incomplete Records

Students of Class 11 should use this Accountancy practice paper to check their understanding of Chapter 11 Accounts from Incomplete Records as it includes essential problems and detailed solutions. Regular self-testing with these will help you achieve higher marks in your school tests and final examinations.

Class 11 Accountancy Chapter 11 Accounts from Incomplete Records Worksheet with Answers

Short Answer Type Questions :

Question: Books maintained under double entry system are more reliable as compared to when maintained under single entry system. Comment.

Answer: Double entry system of accounting records both aspects of a transaction. Thus it provides accurate information as to profit, liabilities, etc. On the other hand, single entry system of accounting does not record transactions in some cases, while in certain others, it records both aspects and in some only one aspect. Thus, double entry system is more reliable than single entry system.

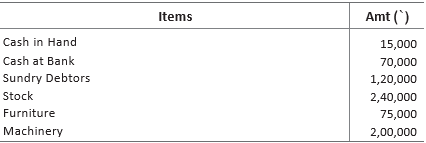

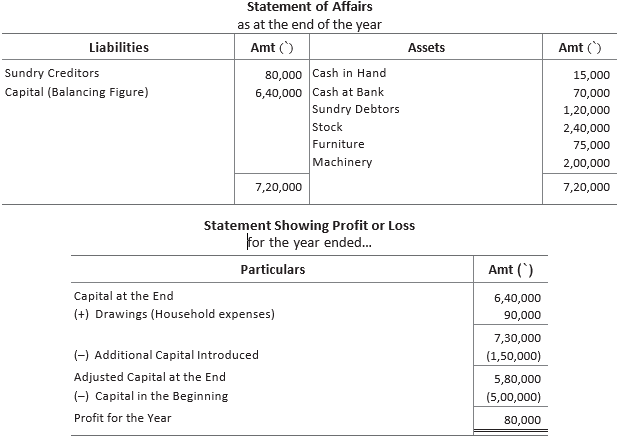

Question: Mr A started business with a capital ₹ 5,00,000. At the end of the year his position was

Sundry creditors on this date totalled ₹ 80,000. During the year, he introduced a further capital of ₹ 1,50,000 and withdrew for household expenses ₹ 90,000.

You are required to calculate profit or loss during the year.

Answer:

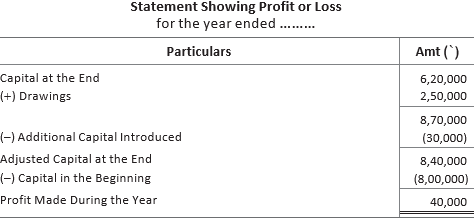

Question: Rishant keeps incomplete records of his business. He gives you the following information; capital at the beginning of the year ₹ 8,00,000; capital at the end of the year ₹ 6,20,000. ₹ 2,50,000 was withdrawn by him for his personal use. As Rishant needed money for expansion of his business, he asked his wife for help, his wife allowed him to sell her ornaments and invest that amount into the business which comes to ₹ 30,000. You are required to calculate profit or loss made during the year.

Answer:

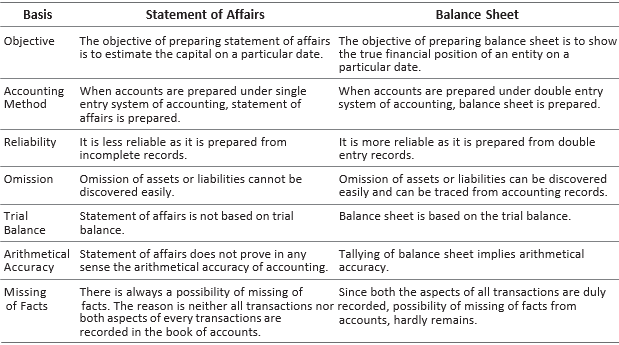

Question: Distinguish between statement of affairs and balance sheet on any four basis.

Answer: The differences between statement of affairs and balance sheet are (any four)

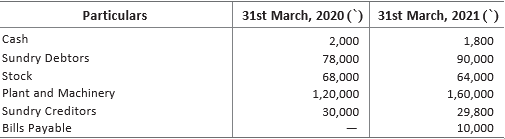

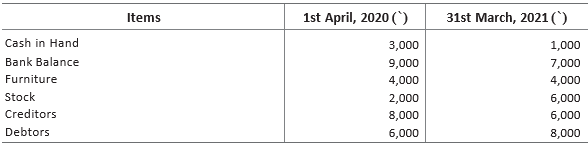

Question: Raja Ram keeps his books under single entry system. His assets and liabilities were as under

Prepare statement of affairs for year ending 31st March, 2020 and 2021.

Answer:

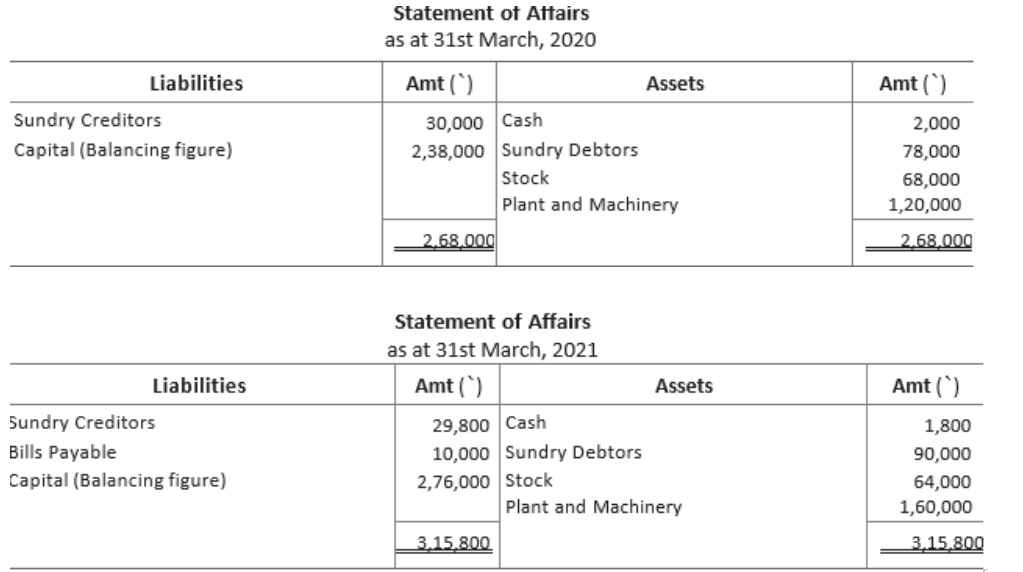

Question: Differentiate between double entry system and single entry system on any four basis.

Answer: The differences between statement of affairs and balance sheet are (any four)

Question: Mention any three features of single entry system.

Answer: Features of single entry system are as follows

(i) It is an inaccurate, unscientific and unsystematic method of recording business transactions.

(ii) Generally records for cash transactions and personal accounts are properly maintained and there is no information regarding revenues and/or gains, expenses and/or losses, assets and liabilities.

(iii) This system is suitable for small size business where the number of transactions are less.

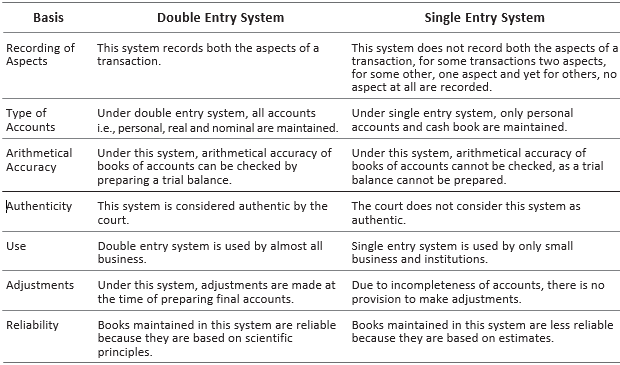

Question: Kartik started a firm on 1st April, 2019 with a capital of ₹ 30,000. On 1st July, 2019, he borrowed from his wife a sum of ₹ 12,000 @ 9% per annum (interest not yet paid) for business and introduces a further capital of his own amounted to ₹ 4,500. On 31st March, 2020 his position was, cash ₹ 1,800, stock ₹ 28,200, debtors ₹ 21,000 and creditors ₹ 18,000.

Ascertain his profit or loss taking into account ₹ 6,000 for his drawings during the year.

Answer:

Note Loan from wife along with interest on loan is a liability for the business and not an additional capital.

Question: What practical difficulties are encountered by a trader due to incompleteness of accounting records?

Answer: The practical difficulties encountered by a trader due to incompleteness of accounting records are

(i) As the accounts are incomplete in nature, there are strong chances of fraud to take place.

(ii) Arithmetical accuracy of accounts under single entry systemcannot be checked, as trial balance cannot be prepared.

(iii) Correct ascertainment and evaluation of financial results of business operations cannot be made.

(iv) Correct profit earned or loss incurred during the accounting period is not known as trading and profit and loss cannot be prepared.

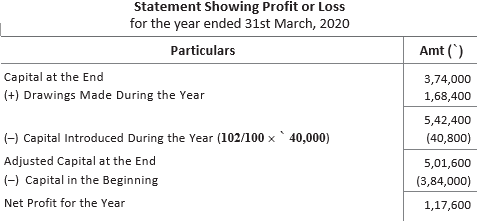

Question: Raghav, who keeps his books on single entry system, tells you that his capital on 31st March, 2020 is ₹ 3,74,000 and his capital on 1st April, 2019 was ₹ 3,84,000. He further informs you that during the year, he withdrew for his household purpose ₹ 1,68,400. He sold his personal investment of ₹ 40,000 @ 2% premium and brought that money into the business.

You are required to prepare statement of profit or loss.

Answer:

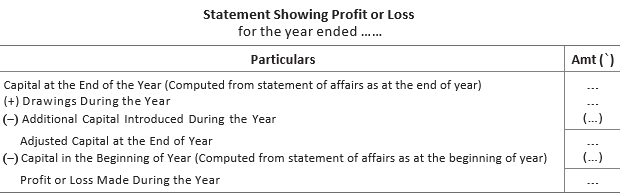

Question: What is meant by statement of affairs? Prepare its format as used for ascertaining profit or loss under incomplete records.

Or

What is meant by statement of affairs? How can the profit or loss of a trader be ascertained with the help of a statement of affairs?

Answer: A statement of affairs is a statement of all assets and liabilities. It is a statement in which assets are shown on one side and the liabilities on the other, just as in case of a balance sheet. Under this method, profits or losses of the business are ascertained by comparing capital at the end, and capital at the beginning of the accounting period. Capital in the beginning is calculated by preparing ‘opening statement of affairs’ and capital at the end is calculated by preparing ‘closing statement of affairs’. After calculating opening and closing capital, a statement showing profit and loss is prepared to ascertain the profit or loss of the period.

Question: What are the possible reasons for keeping incomplete records?

Answer: It is observed that many businessmen keep incomplete records because of the following reasons

(i) Single entry system can be adopted by people who do not have the proper knowledge of accounting principles.

(ii) As specialised accountants are not required, it is an inexpensive mode of maintaining records.

(iii) As only a few books are maintained, time consumed in maintaining records is also less.

(iv) It is a convenient mode of maintaining records as the owner may record only important transactions according to the need of a business.

(v) It is suitable for organisations which have limited number of transactions and very few assets and liabilities.

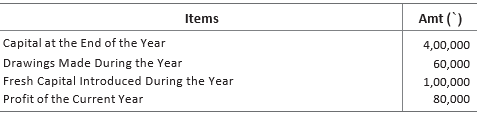

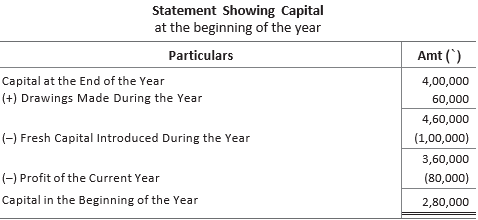

Question: From the following information, calculate capital at the beginning.

Answer:

Long Answer Type Questions :

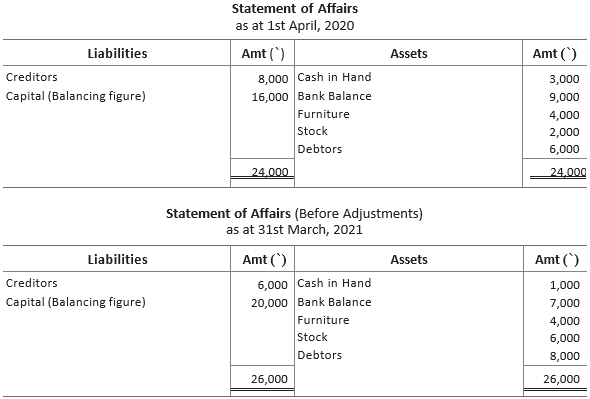

Question: Barkat Lal maintains his account on single entry system. Calculate his profit on 31st March, 2021 from the following information

During the year, his drawings were ₹ 2,000 and additional capital invested was ₹ 4,000. Furniture appreciated by 20% and create a provision on debtors at 5%.

Answer:

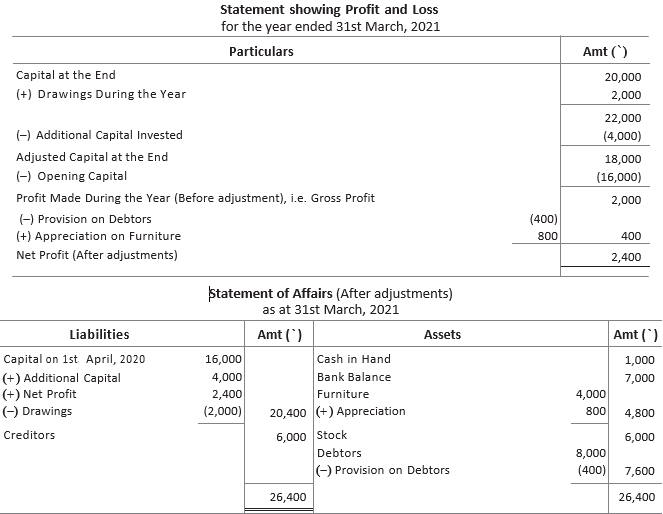

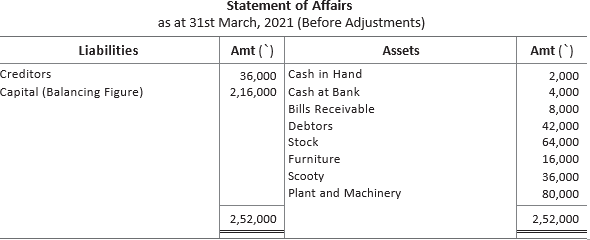

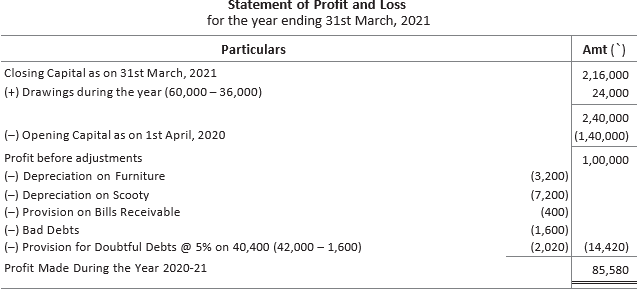

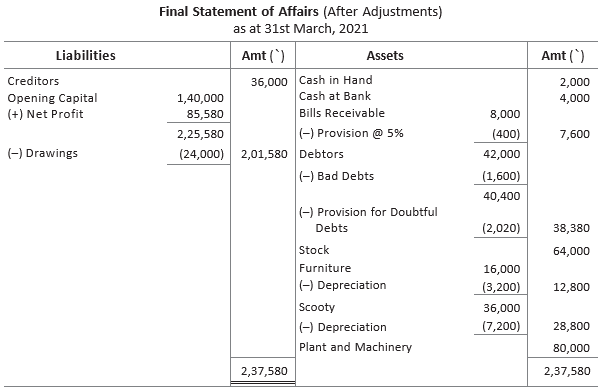

Question: Vijay Sharma keeps incomplete records. The statement of affairs of his business as at 1st April, 2020 was as follows

His position on 31st March, 2021 was Cash in Hand ₹ 2,000; Bills Receivable ₹ 8,000; Stock ₹ 64,000; Plant and Machinery ₹ 80,000; Cash at Bank ₹ 4,000; Debtors ₹ 42,000; Furniture ₹16,000 and Creditors ₹ 36,000. He withdrew ₹ 60,000 during the year, out of which he used ₹ 36,000 for purchasing a scooty for the business. Calculate his net profit for the year after the following adjustments and prepare a final statement of affairs as at 31st March, 2021

(i) Depreciate furniture and scooty @ 20%.

(ii) Make a provision of 5% on bills receivable.

(iii) 5% of the debtors are doubtful and ₹ 1,600 are absolutely bad.

Answer:

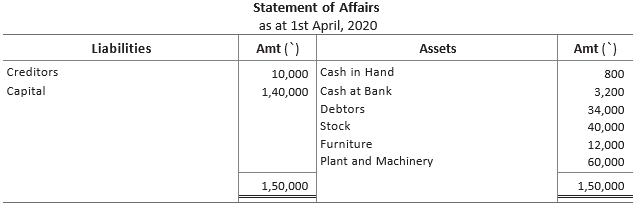

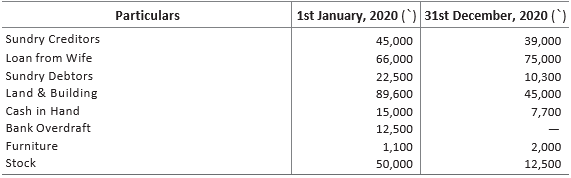

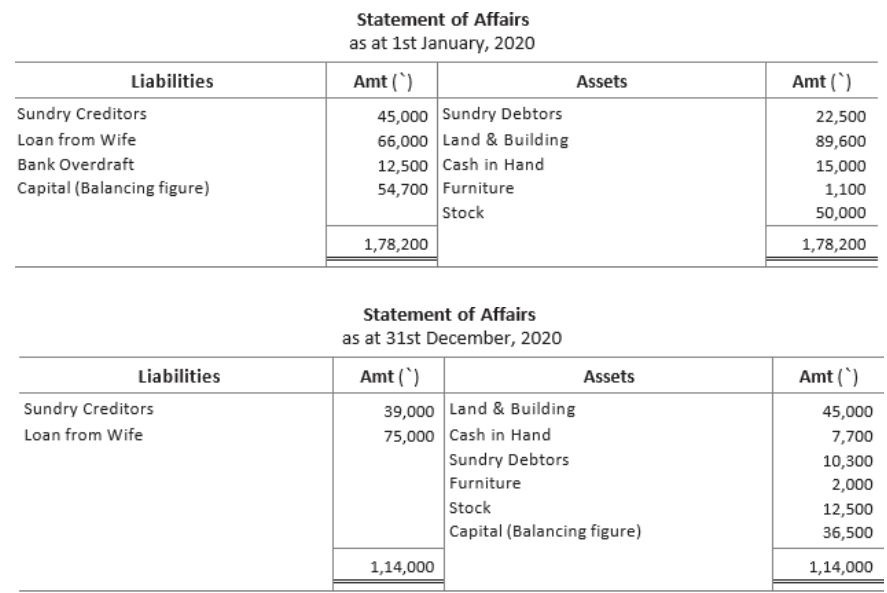

Question: Mr Arun has extracted the following information relating to his business.

Draw up the statement of affairs and find the profit or loss.

Answer:

Working Note

Profit/(Loss) = Capital at the End – Capital in the Beginning = (36,500) − 54,700

∴ Loss = ₹ 91,200

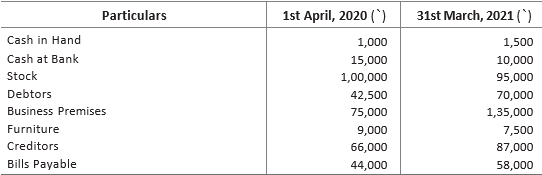

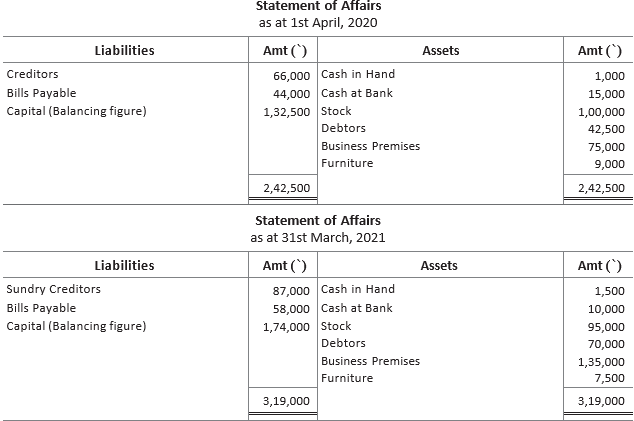

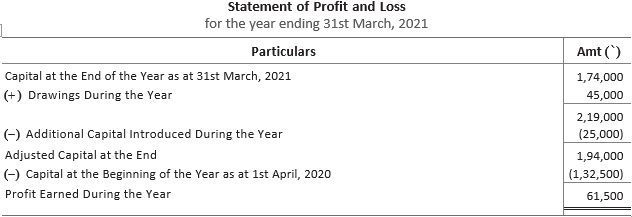

Question: Mr Akshat keeps his books on incomplete records, following information is given below.

During the year, he withdrew ₹ 45,000 and introduced ₹ 25,000 as further capital in the business. Compute the profit or loss of the business.

Answer:

| CBSE Class 11 Accountancy Theory Base Of Accounting Enrichment Worksheet |

| CBSE Class 11 Accountancy Theory Base Of Accounting Worksheet |

| CBSE Class 11 Accountancy Subsidiary Books I Cash Book Worksheet |

| CBSE Class 11 Accountancy Subsidiary Books II Other Books Worksheet |

| CBSE Class 11 Accountancy Bank Reconciliation Statement Worksheet |

| CBSE Class 11 Accountancy Question Bank Worksheet |

| CBSE Class 11 Accountancy Rectification Of Errors Worksheet Set A |

| CBSE Class 11 Accountancy Rectification Of Errors Worksheet Set B |

| CBSE Class 11 Accountancy Depreciation Provisions And Reserves Worksheet |

| CBSE Class 11 Accountancy Financial Statements Worksheet Set A |

| CBSE Class 11 Accountancy Financial Statements Worksheet Set B |

| CBSE Class 11 Accountancy Financial Statements II Worksheet Set A |

Important Practice Resources for Class 11 Accountancy

CBSE Accountancy Class 11 Chapter 11 Accounts from Incomplete Records Worksheet

Students can use the practice questions and answers provided above for Chapter 11 Accounts from Incomplete Records to prepare for their upcoming school tests. This resource is designed by expert teachers as per the latest 2026 syllabus released by CBSE for Class 11. We suggest that Class 11 students solve these questions daily for a strong foundation in Accountancy.

Chapter 11 Accounts from Incomplete Records Solutions & NCERT Alignment

Our expert teachers have referred to the latest NCERT book for Class 11 Accountancy to create these exercises. After solving the questions you should compare your answers with our detailed solutions as they have been designed by expert teachers. You will understand the correct way to write answers for the CBSE exams. You can also see above MCQ questions for Accountancy to cover every important topic in the chapter.

Class 11 Exam Preparation Strategy

Regular practice of this Class 11 Accountancy study material helps you to be familiar with the most regularly asked exam topics. If you find any topic in Chapter 11 Accounts from Incomplete Records difficult then you can refer to our NCERT solutions for Class 11 Accountancy. All revision sheets and printable assignments on studiestoday.com are free and updated to help students get better scores in their school examinations.

You can download the latest chapter-wise printable worksheets for Class 11 Accountancy Chapter Chapter 11 Accounts from Incomplete Records for free from StudiesToday.com. These have been made as per the latest CBSE curriculum for this academic year.

Yes, Class 11 Accountancy worksheets for Chapter Chapter 11 Accounts from Incomplete Records focus on activity-based learning and also competency-style questions. This helps students to apply theoretical knowledge to practical scenarios.

Yes, we have provided solved worksheets for Class 11 Accountancy Chapter Chapter 11 Accounts from Incomplete Records to help students verify their answers instantly.

Yes, our Class 11 Accountancy test sheets are mobile-friendly PDFs and can be printed by teachers for classroom.

For Chapter Chapter 11 Accounts from Incomplete Records, regular practice with our worksheets will improve question-handling speed and help students understand all technical terms and diagrams.