Download the latest CBSE Class 11 Business Studies Small Business Notes Set B in PDF format. These Class 11 Business Studies revision notes are carefully designed by expert teachers to align with the 2025-26 syllabus. These notes are great daily learning and last minute exam preparation and they simplify complex topics and highlight important definitions for Class 11 students.

Chapter-wise Revision Notes for Class 11 Business Studies Chapter 9 MSME and Business Entrepreneurship

To secure a higher rank, students should use these Class 11 Business Studies Chapter 9 MSME and Business Entrepreneurship notes for quick learning of important concepts. These exam-oriented summaries focus on difficult topics and high-weightage sections helpful in school tests and final examinations.

Chapter 9 MSME and Business Entrepreneurship Revision Notes for Class 11 Business Studies

SMALL BUSINESS

Small scale industries contribute significantly to the development process and acts as a vital link in industrialization in terms of production, employment and exports for economic prosperity by widening the entrepreneurial base and use of local raw materials and indigenous skills.

Types of Small Business

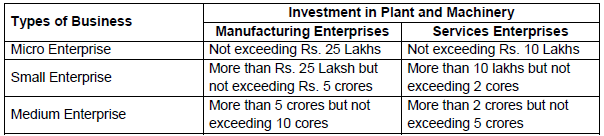

Business enterprises are classified as Manufacturing Enterprises, Service Enterprises,Village Industries and Cottage Industries. Among these manufacturing and service enterprises

are again subdivided into Micro, Small and Medium Enterprises. The definition used by the Government of India to describe small industries is based on the investment in plant and machinery. The Micro, Small and Medium Enterprises Development (MSMED) Act 2006 has been passed by the Government of India to address the issues of small enterprises.

Village Industries – They are located in rural area which produces any goods, renders any service with or without the use of power and in which the fixed capital investment per head or artisan or worker is specified by the central government from time to time.

Cottage Industries – They are also known as Rural Industries or Traditional Industries. They are not defined by capital investment criteria but on the basis of characteristics, which are as

follows:

i. These are organised by individuals with private resources.

ii. Normally use family labour and locally available talent.

iii. Simple equipments are used.

iv. Small capital investment.

v. Produce simple products, normally in their own premises.

vi. Production of goods using indigenous technology.

Role of Small Business in Rural India

Small business organizations play an important role in the socio economic development of the country. Some of them are as follows:

a. Multiple sources of income for family.

b. Self employment opportunities in commerce, manufacturing and service segments.

c. Promotion of agro based rural industries.

d. Employment opportunities for artisans and the weaker sections of society.

e. Migration of rural people to urban areas in search of employment has been stopped.

f. Helped to solve the problem of poverty and unemployment.

g. Helped to reduce the income inequalities up to a certain extent.

h. Accelerated industrial growth of the country.

Problems of Small Business – Following are the major problems faced by small business in India:

1. Finance – One of the severe problems faced by SSIs is that of non-availability of adequate finance to carry out its operations.

2. Raw materials – Availability and procurement of raw material is another major problem faced by the SSIs. Their bargaining power is relatively low due to the small quantity of purchases.

3. Managerial skills – SSIs are generally promoted and operated by single person, who may not possess all the managerial skills required to run the business. They are also not in a

position to afford professional managers.

4. Labour – Productivity per employee is relatively low and employee turnover is generally high due to low remuneration. It also faces lack of specialization.

5. Marketing – In most of the cases, marketing is a weaker area of small organisations; therefore exploitation of middlemen is very more.

6. Quality – Many small businesses do not follow the desired standards of quality due to shortage of finance and resources.

7. Capacity utilization – Many of the SSIs are operating below full capacity due to lack of marketing skills or demand. It will cause to increase its operating cost and leads to sickness and closure of the business.

8. Technology – Most of the SSIs use outdated technology, resulting in low productivity and uneconomical production.

9. Sickness – Due to many internal and external problems, most of the SSIs are in the edge of sickness.

10.Global competitions – Most of the SSIs face competitions not only from medium and large industries, but also from Multinational Companies in the areas of quality, technology,

finance, managerial skills etc.

Government Assistance to Small Industries and Small Business Units

Government provides various support measurers and programs for the promotion of small and rural Industries, some of them are given below:

a. National Bank for Agriculture and Rural Development (NABARD)

· Set up in 1982 for integrated rural development.

· Provides finance to small industries, cottage and village industries and artisans.

· Offers counseling and consultancy services.

· Training and development programs for rural entrepreneurs.

b. Rural Small Business Development Centre (RSBDC)

· It is an initiative of world association for small and medium entrepreneurs.

· It is sponsored by NABARD.

· Giving management and technical assistance to micro and small entrepreneurs in rural areas.

· Organizing programs on rural entrepreneurship, skill upgradation workshop,training programs etc.

c. National Small Industries Corporation (NSIC)

· Set up in the year 1955 to promote and foster the growth of SSIs in India.

· Supply of indigenous and imported machines on hire purchase basis.

· Supply of raw materials – locally and imported.

· Support in export of products.

· Monitoring and advisory services.

· Providing latest technology.

· Awareness on technological upgradation.

· Development of software technology parks and technology transfer centres.

d. Rural and Women Entrepreneurship Development (RWED)

· To create a business environment to encourage rural and women entrepreneurs.

· To enhance the productivity of labors and institutions.

· To provide training for women entrepreneurs.

· To give advisory services in all respects.

e. Scheme of Fund for Regeneration of Traditional Industries (SFURTI)

· Established in 2005 to make traditional industries more productive and competitive.

· Implemented by Ministry of Agro and Rural Industries in collaboration with State Governments.

· To develop clusters of traditional industries in various part of the country.

· To make traditional industries more innovative and profitable.

· To create sustainable employment opportunities in traditional sector.

f. District Industries Centres (DICs)

· Established in 1978

· To support small entrepreneurs at district level.

· Provides all facilities and support to set up small and village industries.

· Identification of suitable schemes for entrepreneurs by Central and State Govts.

· Preparation of feasibility reports on each industry.

· Arrangement of credit facilities and equipments.

· Arrangement of raw materials.

· To impart training for artisans, entrepreneurs etc.

Entrepreneurship Development

The word entrepreneur is derived from the French verb entreprende, which means to undertake. Entrepreneurship is the process of setting up of one’s own business. The person

who sets up the business is entrepreneur and the outcome of the process (business unit) is called enterprise.

“Entrepreneur is a person who organizes the business, undertakes the risk and enjoys the profit” – Richard Cantillon_French Economist.

An entrepreneur is basically a businessman and he brings together the factors of production such as land, labour and capital and organizes it. An entrepreneur is more than a businessman,

if a businessman brings some innovation to his activities and eyes on value addition to his products or services, he is called an entrepreneur. In fact, all entrepreneurs are businessmen,

but all businessmen are not entrepreneurs.

“Entrepreneurship is the purposeful activity of an individual or a group of associated individuals, undertaken to initiate, maintain or organize profit oriented business unit for production or distribution of economic goods and services.”

Characteristics of Entrepreneurship

1. Systematic activity – Entrepreneurship is a systematic, step by step and purposeful activity. It requires skill, knowledge and competency which can be acquired, learnt and developed through education, training, observation and experience. Thus we can say the entrepreneurs are made but not born.

2. Lawful and purposeful activity – The aim of entrepreneurship is to run a lawful business.

3. Brings innovation and creativity to the business.

4. Organizes production – The entrepreneur brings the idea of business and the factors of production, thus he organizes the production activities.

5. Risk taking – The entrepreneur takes all the risks in the business as he brings all the factors of production including capital.

Startup India Scheme

Startup India Scheme is an important initiative by Govt. of India to promote a strong ecosystem for nurturing innovation and startup (new enterprises) in the country. As per the notification of the Ministry of Commerce and Industry, a startup means:

1. An entity incorporated or registered in India.

2. Not older than 5 years.

3. Annual turnover does not exceed Rs.25 crores in any preceding year.

4. Working towards innovation, development or comercialisation of products or services with the support technology or Intellectual Property Rights (IPR) and Patents.

Popular Startups in India – Paytm, Flipcart, Snapdeal, Swiggy, Bigbasket, Byju’s App, Ola

Cabs, Make My Trips, ShopClues, OYO Rooms, Zomato, Redbus, Uber Eats etc.

Aims and Objectives of Startup Scheme:

1. Trigger an entrepreneurial culture.

2. Create awareness about the charms of entrepreneurship among the youth.

3. Encourage more dynamic startups by motivating educated youth as a good career.

4. To support the startups in various stages such as pre-startup stage, nascent (beginning stage) and early post startup stage.

5. To promote under represented target groups such as women, back communities, scheduled castes, scheduled tribes etc.

Startup India – Action Point

1. Simplification and hand-holding – Formalities simplified and extended support to the startup ventures.

2. Startup India Hub – To create a single point contact for the entire startup system and to enable knowledge exchange and access to funding.

3. Legal support and fast tracking Patent Examination – To give protection for patents, trademark and designs of innovative startups through SIPP (Startups Intellectual Property Protections).

4. Easy Exist – In the event of failure and wind up of operations, procedures are adopted to reallocate capital and resources towards more productive avenues. Thus the entrepreneurs can easily exit from the business if required.

5. Incubator setup – The government envisages setting up of incubators across the country in PPP mode (Private Public Partnership).

6. Tax exemption – The profit of startup initiatives are exempted from Income Tax for a period of 3 years.

Ways to fund startup

1. Boot Strapping – Self financing by the promoters from their personal savings and resources.

2. Crowd Funding – Pooling resources by a group of people for a common goal especially through internet platforms.

3. Angel Investment – Angel investors are the individuals with surplus cash who have keen interest to invest in startups. They also offer mentoring or advice along with capital.

4. Venture Capital – Venture capitalists provide professionally managed funds to companies and startups that have huge potential. It is also called risk capital as it is invested in new ventures. Eg: Accel Partners, Blume Ventures etc.

5. Business Incubators and Accelerators – Incubators provide funds for startups in the early stage of its business, whereas accelerators help the startups to run or to take a giant leap in business. Eg: Angel Prime, Khosla Labs, Startup Village etc.

6. Microfinance and NBFCs – Microfinance is a category of financial services targeted at individuals and small business who lack access to conventional banking or who have not qualified for a bank loan. Eg: BSS Microfinance P Ltd. , Asirvad Microfinance Pvt. Ltd. etc.

NBFCs (Non Banking Financial Companies) are registered under Indian Companies Act and they perform only lending functions to public and they cannot accept deposits. Eg: Mahindra & Mahindra Financial Services Ltd., Muthoot Finance Ltd., Bajaj Finance Ltd. etc.

Intellectual Property Rights (IPR)

Intellectual Property is a category of property that includes intangible creations of human intellect. The most prominent types of intellectual properties are trade secrets, copyrights, patents, trademarks etc. All inventions begin with an idea. Once the idea becomes an actual product, that idea is treated as an intellectual property. The legal rights conferred on such

products (idea) are called IPR. Once it is allotted to a person by the Govt. authority, he/she can rent, give or sell it to others.

Intellectual property is divided into two categories: Industrial properties like trademarks, industrial designs etc. and copyrights which includes literary and artistic works such as novels, poems, plays, films music, photographs, drawings, paintings, sculptures, architectural designs etc.

Importance of IPR

1. Path-breaking inventions – It encourages new inventions in all segments. Eg: Cancer cure medicines.

2. Incentive – It incentivizes inventors, authors, creators etc. for their work.

3. Helps to prevent loss of income – It allows the inventor to sell the rights to third parties and thus he/she can generate income.

4. Recognition – It helps authors, creators etc. to get recognition for their work.

Famous Legislations and Agreements on IPR

1. TRIPS – Trade-Related Intellectual Property Systems Agreement (a part of WTO).

2. Trade Mark Act 1999.

3. Geographical Indications of Goods (Registration and Protection) Act 1999.

4. Designs Act 2000.

5. Protection of Plant Varieties and Farmers’ Rights Act 2001.

6. Patents Act 2005.

7. Copyright (Amendment) Act 2012.

Types of IPs

1. Copy Right – It is the right to “not copy” conferred upon the creators of literary, artistic, musical, sound recording, films etc.

2. Trademark – Any word, name, or symbol that gives an identity to goods or service made by an individual, company, organization etc. (To register the trademark you can visit www.ipindia.nic.in).

3. Geographical Indication – GI is an identification which identifies agricultural, natural or manufactured products originating from a definite geographical territory. Eg: Banaras Brocades, Kashmiri Pashmina Woolen Shawl, Nagpur Orange etc.

4. Patent – It is an exclusive right granted by the government to prevent others from making, using, offering for sale, selling or importing the invention. For an invention to be patentable, it must be new, non-obvious (not easily discoverable) and having an industrial application.

5. Design – It includes shape, pattern etc. that is applied to any article. Eg: Design of a car, house, bottle etc. The term of protection of a design is valid for 10 years, which can be renewed for further 5 years. After that it will come under public domain.

6. Plant Variety – It is a type of variety which is bred and developed by farmers. Eg: hybrid versions of potatoes, rice, pepper etc. This lead to the growth of seed industry.

7. Semiconductor Integrated Circuits Layout Design – It is used to perform electronic circuitry function. Eg; Computer Chip.

| CBSE Class 11 Business Studies Nature And Purpose Of Business Notes Set A |

| CBSE Class 11 Business Studies Nature And Purpose Of Business Notes Set B |

| CBSE Class 11 Business Studies Forms Of Business Organisation Notes Set A |

| CBSE Class 11 Business Studies Forms Of Business Organisation Notes Set B |

| CBSE Class 11 Business Studies Public Private And Global Enterprises Notes Set A |

| CBSE Class 11 Business Studies Public Private And Global Enterprises Notes Set B |

| CBSE Class 11 Business Studies Business Services Notes Set A |

| CBSE Class 11 Business Studies Business Services Notes Set B |

| CBSE Class 11 Business Studies Emerging Modes Of Business Notes Set A |

| CBSE Class 11 Business Studies Emerging Modes Of Business Notes Set B |

| CBSE Class 11 Business Studies Social Responsibilities Of Business And Business Ethics Notes Set A |

| CBSE Class 11 Business Studies Social Responsibilities Of Business And Business Ethics Notes Set B |

| CBSE Class 11 Business Studies Formation of a Company Notes Set A |

| CBSE Class 11 Business Studies Sources Of Business Finance Notes Set A |

| CBSE Class 11 Business Studies Sources Of Business Finance Notes Set B |

| CBSE Class 11 Business Studies Small Business Notes Set A |

| CBSE Class 11 Business Studies Small Business Notes Set B |

| CBSE Class 11 Business Studies Internal Trade Notes Set A |

| CBSE Class 11 Business Studies Internal Trade Notes Set B |

| CBSE Class 11 Business Studies International Business Notes Set A |

| CBSE Class 11 Business Studies International Business Notes Set B |

Important Practice Resources for Class 11 Business Studies

CBSE Class 11 Business Studies Chapter 9 MSME and Business Entrepreneurship Notes

Students can use these Revision Notes for Chapter 9 MSME and Business Entrepreneurship to quickly understand all the main concepts. This study material has been prepared as per the latest CBSE syllabus for Class 11. Our teachers always suggest that Class 11 students read these notes regularly as they are focused on the most important topics that usually appear in school tests and final exams.

NCERT Based Chapter 9 MSME and Business Entrepreneurship Summary

Our expert team has used the official NCERT book for Class 11 Business Studies to design these notes. These are the notes that definitely you for your current academic year. After reading the chapter summary, you should also refer to our NCERT solutions for Class 11. Always compare your understanding with our teacher prepared answers as they will help you build a very strong base in Business Studies.

Chapter 9 MSME and Business Entrepreneurship Complete Revision and Practice

To prepare very well for y our exams, students should also solve the MCQ questions and practice worksheets provided on this page. These extra solved questions will help you to check if you have understood all the concepts of Chapter 9 MSME and Business Entrepreneurship. All study material on studiestoday.com is free and updated according to the latest Business Studies exam patterns. Using these revision notes daily will help you feel more confident and get better marks in your exams.

You can download the teacher prepared revision notes for CBSE Class 11 Business Studies Small Business Notes Set B from StudiesToday.com. These notes are designed as per 2025-26 academic session to help Class 11 students get the best study material for Business Studies.

Yes, our CBSE Class 11 Business Studies Small Business Notes Set B include 50% competency-based questions with focus on core logic, keyword definitions, and the practical application of Business Studies principles which is important for getting more marks in 2026 CBSE exams.

Yes, our CBSE Class 11 Business Studies Small Business Notes Set B provide a detailed, topic wise breakdown of the chapter. Fundamental definitions, complex numerical formulas and all topics of CBSE syllabus in Class 11 is covered.

These notes for Business Studies are organized into bullet points and easy-to-read charts. By using CBSE Class 11 Business Studies Small Business Notes Set B, Class 11 students fast revise formulas, key definitions before the exams.

No, all study resources on StudiesToday, including CBSE Class 11 Business Studies Small Business Notes Set B, are available for immediate free download. Class 11 Business Studies study material is available in PDF and can be downloaded on mobile.